Main menu

You are here

Addendum: Triple-Tax Model Details

Originally, this article was published without this addendum and was met with some criticism on social media. There were two sorts of objections. The first was simply, “Where is the data and evidence to substantiate these claims?” or “What are you talking about?” The second sort of objection, coming from policy wonks and tax experts, suggested that my analysis is wrong. This addendum should address all such objection and clear some things up.

More Info on Marginal Income Tax Rates on Top Brackets

High top marginal income tax rates effectively serve as a maximum wage and induce corporations to spend a greater portion of their excess profits on paying their workers better wages rather than on paying senior executives more.

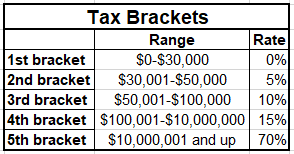

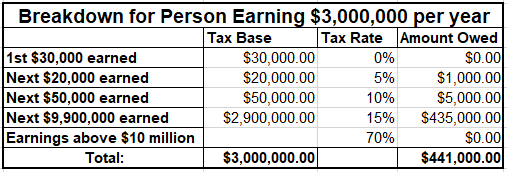

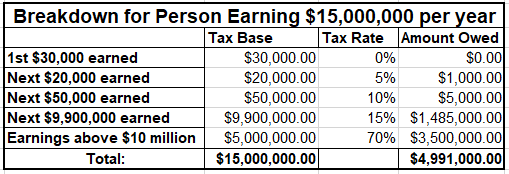

The American income tax system is a progressive system with marginal rates. I’ll start by explaining how such a system works. Suppose you have a marginal tax rate of 5% that kicks in at an income of $30,000 per year, a rate of 10% that starts at $50,000 per year, and a rate of 15% that starts at $100,000, and a rate of 70% that kicks in at $10,000,000 per year. A person earning $10,100,000 per year would not pay a ridiculous $7,070,000 as lying pundits at Fox News would have you believe, but would rather pay $1,561,000 total in income taxes, which is an effective rate of closer to 15% — the 70% rate only applies to the last $100,000 earned.

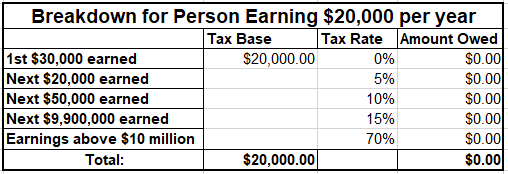

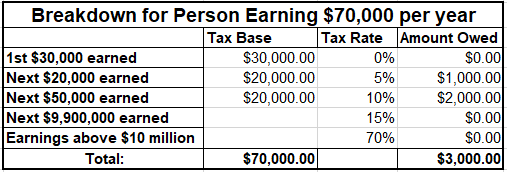

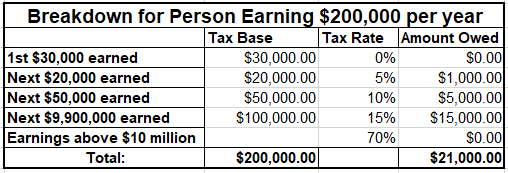

The following charts show our theoretical tax brackets and how much people would have to pay at various different income levels.

width="507" height="172" />

width="507" height="172" />

Under such a tax code (which is the same type of tax system as we have in America), the rate of the tax bracket that you fall into does not apply to all of your income. If you are in the 10% tax bracket, that only applies to your income above $50,000 dollars: your first $30,000 is tax-free, your next $20,000 only gets taxed at 5%, and only the income above $50,000 will be taxed at 10%. At no point can a raise ever result in you bringing home less money.

Now that we’ve explained how marginal tax rates in a progressive income tax system work, let’s dive into the virtues of such a tax system. As a nation, America is becoming more wealthy. We are seeing productivity increase and GDP go up, but real wages are falling. The gap between the people at the top and the people at the bottom, in terms of wealth, is growing increasingly larger. It is my contention that this is the direct result of tax policy.

Why do we simultaneously have growth in GDP, an increase in real wealth overall, alongside declining wages for the vast majority of the populace? Well, historically high marginal income tax rates on the top earners led to rising wages overall. When marginal tax rates are high for the people at the top, the people at the top tend to keep less of the profits for themselves because the tax shifts the marginal utility of lining one’s own pockets relative to the marginal utility of raising wages. When profits exceed the amount that the rentier/capitalist class can siphon off without government confiscating it via tax policy, the owners of industry will use that excess to raise wages for their employees rather than increasing their own income and thereby losing the bulk of the money to higher taxes. The higher the marginal tax rates on the top earners, the higher the average wages in the economy are. By imposing high marginal income tax rates upon the wealthy, the government circumvents the impoverishment of the working class that Marxists predict and ensures that wages rise as productivity and wealth increase. When top earners have lower marginal tax rates, all new wealth goes to CEOs and other people at the top. When conservatives cut taxes on the wealthy, it causes wages to stagnate.

The recession ended in June of 2009, the economy started to grow again, but many people still feel like they’re stuck in the recession. While GDP has increased since 2009, real unemployment remains high and wages have been declining. While the economy is expanding and wealth is increasing, none of it is trickling down to the people. Instead, the newly created wealth is all going to the top 1%. [Note: Unemployment numbers are based on people actively searching for jobs but unable to find them. By “real unemployment,” I mean the actual number of people without jobs, including people who have stopped searching and decided to go on Disability, or made other such arrangments, instead of continuing to seek employment.]

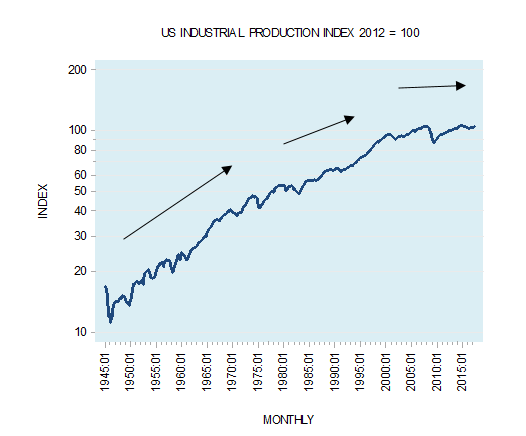

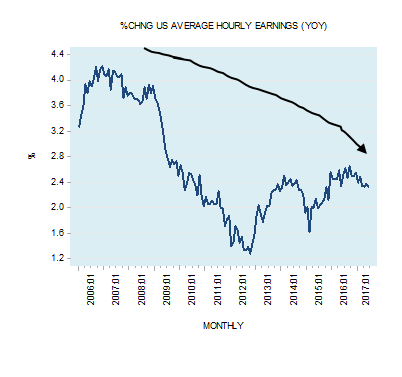

The two charts below show the paradox of rising productivity alongside falling wages.

Image Source: Frank Shostak, in Mises Wire (https://tinyurl.com/y394beoo)

Image Source: Frank Shostak, in Mises Wire (https://tinyurl.com/y394beoo)

The two charts above illustrate that there is a problem, but the two charts below help us see a larger view of what is happening and even help us to pinpoint when things started going wrong.

Image Source: Paul L. Caron, Dean of Pepperdine Law, on TaxProf Blog (https://tinyurl.com/y2fho9f7)

Image Source: Stan Sorscher, in The Huffington Post (https://tinyurl.com/y38rau47)

After reading the next few paragraphs, you may want to refer back to these graphs again, as they will likely start to make more sense.

In the 1920s, the economy was booming. The whole populace in America seemed to be rising from the ashes. In 1916, the top marginal tax rate was just 15%, but that was raised to 77% in 1918. The result was the booming 20s. The higher marginal tax rate induced businesses to pay their workers more because lining the pockets of CEOs and capitalists would just result in government confiscating the majority of the pay increase. Wages rose throughout the economy. Since workers are also consumers, the higher wages for the workers meant more spending money for consumers. This stimulated the economy and sparked unprecedented growth. In the latter half of the 1920s, however, the government cut the marginal tax rate for the highest earners down to 25%, which led to the disaster of the 1930s and the Great Depression. The Great Depression dragged on as long as taxes on the wealthy remained low and wages, consequently, remained low. World War II pulled the United States out of the Great Depression, not because war is inherently good for the economy as some Keynesians suggest, but because it induced the government to increase the top tax rates. When the United States began preparing for war in the late 1930s and entered the war in 1941, it had to raise the tax rate on the wealthy in order to fund the war effort. They couldn’t just tax the working class since the working class didn’t really have any money, so they raised the top tax rate. By 1944, they had raised the top tax rate to 94%. It is true that government spending for the war created jobs and helped to stimulate the economy, but it was the increase in top tax rates that led to rising wages for the working class and allowed the economy in general to recover so that the 1950s could be the Booming 1950s. The war and government spending only helped the situation insofar as they affected a redistribution of wealth downwards, thereby counteracting the immiseration effect. [Note: The “immiseration effect” refers to Karl Marx’s prediction that the profit motive would cause businesses/capitalists, under free-market conditions, to seek to cut costs by paying the lowest possible wage until wages are so low that workers are barely able to survive.]

Starting in the mid-1970s, the top tax rates were reduced under Richard Nixon. These tax cuts have never been undone. American wages have not risen since these tax cuts went into effect. The Tax Reform Act of 1986 dropped the top income tax rate to 28% (compare that to 70% in 1980). Such tax policies, although generally favored by conservatives, are economically unsound and unethical, and result in stagnating wages in spite of increased productivity. The end result is that while workers produce more, corporations and wealthy individuals end up taking more of a share of that wealth rather than raising wages for the working populace. The Trump tax cuts are going to exacerbate this problem, making another Great Depression nearly unavoidable, and will ensure that American wages won’t rise in the foreseeable future.

Henry Ford was an advocate of paying workers enough to buy the product. At the end of the day, the workers are also consumers. If all of the businessmen in an economy begin to pay subsistence-level wages, so that the working class majority cannot afford to purchase luxury items, then the economy will enter into a depression. That’s essentially what causes recessions. There are many different factors that contribute to the creation of situations wherein the consumers cannot afford to purchase the products they produce. I am aware of the other contributing factors to recessions/depressions, but the role of monetary/fiscal policy in allowing wealth to trickle upwards is by far more significant than any other. Economic recessions have several causes and contributing factors, so I do not mean this to be seen as contradicting classical Ricardian, Austrian, and Monetarist theories of the business cycle. Most business cycle theories are correct but incomplete. Contraction of the money supply, malinvestment sparked by “artificially” low interest rates, and foreclosures are contributing factors, all of which lead to more money concentrated in the hands of a few people at the top and less income for the average working-class people that make up the majority of the populace. A recession occurs because there is a lack of spending or a substantial reduction in spending as a result of the general populace becoming poorer in real terms. When the average consumer/worker becomes poorer, aggregate demand falls, creating a general glut as the consumers fail to buy up all the products they have produced as workers. As a result of the decrease in aggregate demand, industries will start cutting back on production and laying off workers. Such a downward spiral can easily be sparked by cutting taxes for the wealthy. The conclusion I am drawing here is that conservative economic policies naturally lead to recessions, stagnant wages, and high unemployment.

A government can ensure decent wages by imposing a minimum wage or by imposing a high top marginal income tax rate. An excessively high top marginal income tax rate effectively serves as a maximum wage policy. No one pays that tax rate. Instead, businesses will evade the tax by investing their money, either investing directly in labor by raising the wages they pay or by investing otherwise, which investment often tends to raise the average wage indirectly by creating new jobs.

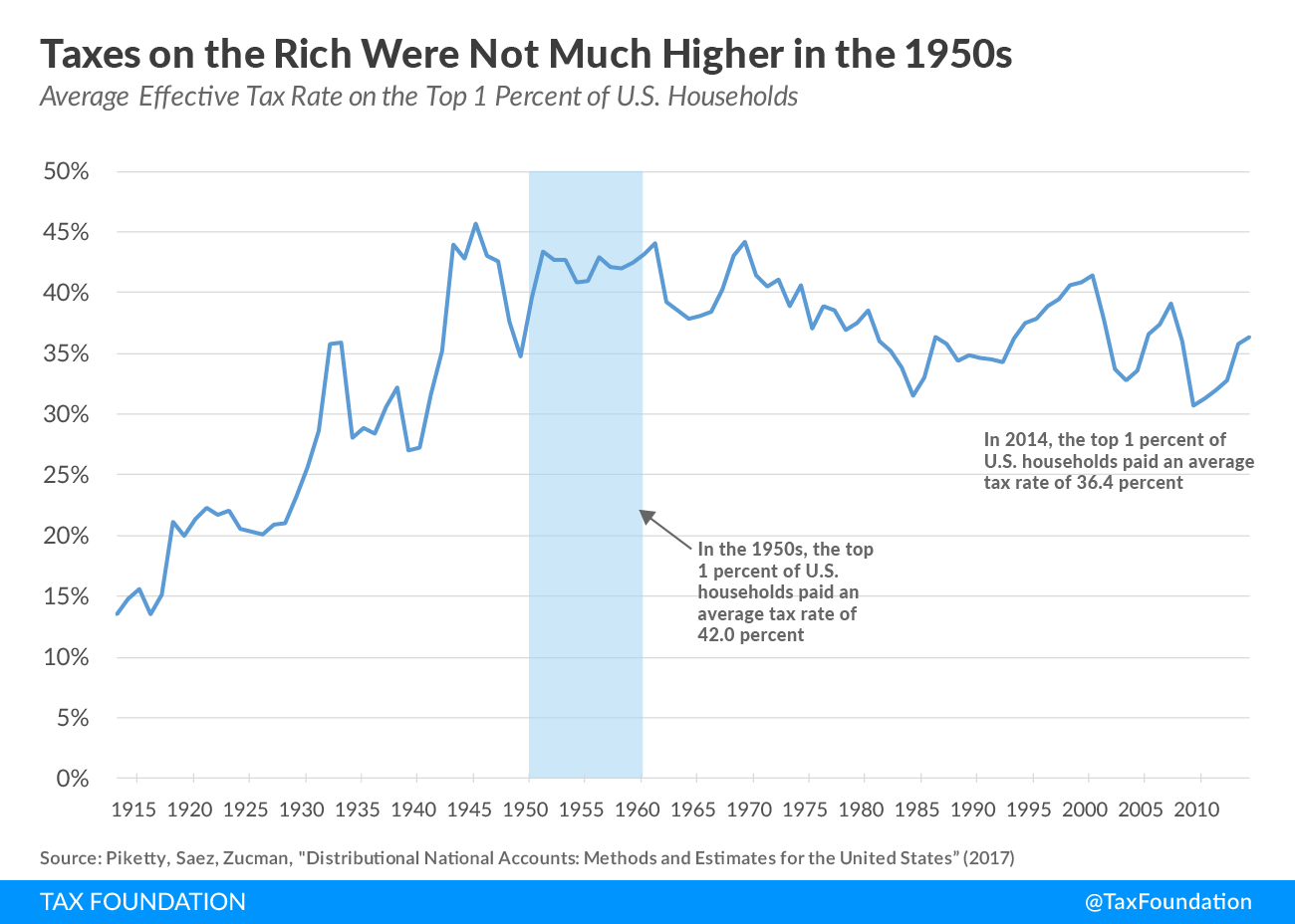

If high top marginal income tax rates are working correctly, no one will pay them. Instead, they will evade the tax by investing in higher wages, better benefits, or production that benefits the people in general. In the 1950s, when there was a 91% income tax rate, the top 1%, on average, didn’t pay much more in taxes than they do now.

Image Source: Scott Greenberg of Tax Foundation (https://tinyurl.com/y5z73sfd)

The difference between then and now is not that the wealthy paid more taxes back then but rather that the wealthy hoarded less of the wealth back then. The high marginal tax rate on top brackets did not generate much revenue but did encourage a more equitable distribution of wealth. Thus, high marginal tax rates on top income brackets ought not to be seen as a tool for generating revenue but rather as a mechanism for encouraging a more just distribution of income by driving up wages. High marginal income tax rates on top earners functionally serve as a maximum income, encouraging CEOs to raise wages and let the wealth trickle down — so, ironically, the diametrical opposite of Trickle-Down Economics actually leads to a real trickle-down effect. This is how the Nordic countries are able to maintain their high wages in spite of having no minimum wage law.

More Info on Land Value Tax

I’ll start by explaining what a land value tax is. A land value tax (LVT), as opposed to a property tax, is a tax on the value of land minus the value of the structures on it. I own a house that is assessed at $150,000. The value of the land is $10,000. We built the house ourselves, with the help of friends and family, so most of the value of the house is the result of labor we put in and the money we spent on building it. With a system of land value tax, I will not be taxed on the $140,000 value of the house itself but only on the $10,000 value of the land. So, with a 6% LVT, I would owe $600 per year in taxes on this property. However, a land speculator who owns a rundown abandoned building in a metropolitan area would have a different situation. This rundown building is only worth $15,000 but the land it is on is worth $100,000. The speculator is hoarding this valuable land and holding it out of use in the hopes of making a ton of unearned income by selling it at an inflated price in the future. Under the same land value tax, this speculator would pay $6,000 per year in LVT. For more information on land value tax, check out Progress and Poverty by Henry George.

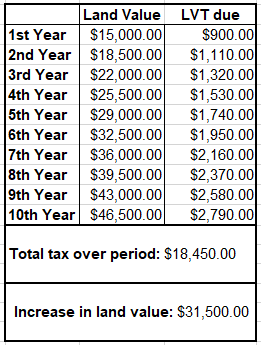

The imposition of a land value tax (LVT) shifts the marginal utility of buying land for speculative purposes relative to investing in other things. In the absence of a land value tax, I can buy a plot of land for $15,000 and sell it for $46,500 a decade later without having contributed any labor or additional money at all. The development of infrastructure in the surrounding area (e.g. roads, utilities, grocery stores, gas stations, etc.) drives up the value of my land. When there was no road leading to the property and no electricity, cable, or internet available at the site, it was worth very little. All the labor that raised the value of my land was contributed by the community rather than by me as an individual. When I sell the land, I make $31,500 in unearned increase. A land value tax of 6% per year would drastically change matters. Under this LVT of 6%, I will make $31,500 at the end of the ten years but will also have had to pay $18,450 in taxes on that land during the same period. Consequentially, my unearned increase in now only $13,050. There is a 59% reduction in the unearned increase that can be made from speculating on the land in question. Thus, LVT reduces the rewards for speculation, thereby checking the practice.

Land speculation is the main factor that drives up land values and, consequentially, makes housing unaffordable. Land speculation is also a key factor in driving the boom-and-bust cycle. By reducing the rewards for speculators, LVT will reduce speculation in land. This, in turn, will reduce land prices, thereby making housing more affordable. However, in doing so, LVT also reduces the amount of revenue it can capture. By reducing land values, it reduces the amount of revenue that can potentially be captured by taxes based upon land value. Thus, LVT ought not to be seen as a tool for generating revenue but rather as a mechanism for making housing affordable, curbing excesses of speculation, and creating stability in the housing/land market.

More Info on Value-Added Tax

At its most basic, a VAT taxes the value a business adds to a good or service as it is being produced. The added value may be thought of as the price at which the business sells its product minus the cost of producing it.

“ For example, a wholesale bakery earns revenue by selling bread to grocery stores. Subtract from that the bakery’s spending on flour, yeast and other ingredients. The difference is the added value on which the bakery is taxed. In addition, the flour company would pay a VAT on the revenue from its flour minus what it pays for wheat and the like.

“ When you tally the value added at every stop on the supply chain, from wheat farmer to bread eater, you get the retail price of the bread. Thus a VAT is a tax on consumption and it can be easier to administer than a personal income tax.” — Seema Jayachandran, Why a Tax the U.S. Hasn’t Embraced Has Found Favor in Much of the World

A value-added tax (VAT) is an indirect tax. Rather than being collected directly from individuals, like an income tax, it is collected from businesses. Every time there is “value added” (or, more precisely, a profit is made), a little share of that value (profit) is collected by the government.

“A VAT resembles a sales tax, with an important difference: It is paid at every stage of production, not just the point of sale. That makes a VAT marvelously self-enforcing, because one firm’s tax deductions are another firm’s tax liability.

“When the baker buys flour, it is in her financial interest to inform the tax authority about the purchase, so that she can deduct the cost from her tax base. That information alerts the tax authority about the flour producer’s income.” — ibid.

It is interesting to me that many people on the far left are strongly opposed to VAT. This is interesting for several reasons. First, because all the progressive countries in Europe, with either Nordic model social democracy or a social market economy, utilize VAT. Second, because a VAT seems to make sense within a Marxian framework. And, finally, because, although VAT is a regressive tax, it can easily be turned into a progressive tax.

VAT seems to make sense from a Marxian perspective. The capitalist sells his product at a rate higher than the cost of production (i.e. price of materials and shipping plus the price of labor) — this constitutes their profit margin. According to Marxist theory, this profit margin represents a surplus value produced by labor. The addition of labor into the mix raises the value of the raw material. However, the capitalist tends to only pay the laborer a fraction of the value his labor creates. The capitalist siphons off the remainder of the value created by labor — the surplus value — and keeps it for himself as profits. Marx defined exploitation as the siphoning off of this surplus value produced by someone else’s labor. From a Marxian perspective, the capitalist has no just claim to this surplus value that constitutes his profits. I would argue that a VAT is actually a tax on profits. Profits are coterminous with surplus value. A VAT taxes every transaction wherein value is added and a profit is taken. If we impose a value-added tax and redistribute the revenue back to the workers directly, there is less exploitation in the Marxian sense since a portion of the surplus value has been returned to the workers. However, I will note that the Marxist, to be consistent with Marxian principles, would likely have to advocate for the gradual raising of the VAT until it reaches 100%. At that point, profits would cease to exist and things would trade at cost of production, similar to what Josiah Warren and Pierre-Joseph Proudhon hoped for. This could be seen as a way to help markets whither away in a transition to communism, as a 100% VAT would eliminate market incentives. I would argue that taking VAT to such an extremely high rate would be absurd and would result in a crippling economic depression and social collapse long before ushering in any sort of communism.

A VAT, in and of itself, is regressive. A poor person who lives paycheck-to-paycheck spends all their income, without saving any amount of their income. This means that the poor person is taxed on 100% of their income under a simple VAT. A rich person, on the other hand, does not spend all their income and so ends up being taxed on a smaller share of their income. This, at first sight, seems to be a pretty damning argument against VAT. However, it is fairly easy to render a VAT more progressive. One way to do this is to make necessities VAT-exempt. This is precisely what Andrew Yang has proposed. He has suggested that only luxury items would be VATable. Thus, he refers to his plan as a “luxury VAT.” Additionally, Yang’s VAT would exist alongside a universal basic income (UBI). The UBI effectively transforms Yang’s VAT into a progressive tax, even if he doesn’t exempt staple items.

“A VAT would result in slightly higher prices. But technological advancement would continue to drive down the cost of most things. And with the backdrop of a universal basic income of $12,000, the only way a VAT of 10 percent makes you worse off is if you consume more than $120,000 in goods and services per year, which means you’re doing fine and are likely at the top of the income distribution. Businesses will benefit immensely from the fact that their customers will have more money to spend each month — most Americans will spend the vast majority of their money locally.

“The hedge fund billionaire who spends $10 million a year on private jets and fancy cars will pay $1 million into the system and receive $12,000. The single mom will pay about $2,500 and receive $12,000, and will also have the peace of mind that her child will start receiving $1,000 a month when he or she graduates from high school.

“For people who consider this farcical, consider the bailouts that took place during the financial crisis. You may not recall that the U.S. government printed over $4 trillion in new money for its quantitative easing program following the 2008 financial collapse. This money went to the balance sheets of the banks and depressed interest rates. It punished savers and retirees. There was little to no inflation.” — Andrew Yang (The War on Normal People, Ch. 16)

Even in the absence of a universal basic income, there are other means by which a government can render a VAT more progressive. An easy way would be to give a tax credit to people in the lowest income brackets. Alternatively, you could issue a “prebate,” like the one associated with the FairTax proposals. You could calculate the average level of spending for people at the poverty line (or the average cost of living expenses), and give everyone a preemptive rebate (prebate) of that amount. This would effectively serve as a tax exemption, rendering the tax more progressive by shifting the burden upwards towards people higher up on the income scale.

Some More Objections Considered

High Marginal Tax Rates Could Lead to More Investment in Rent-Seeking

The first objection to consider is related to the idea of marginal income tax encouraging either reinvestment or wage increases. To avoid the higher rate, one can either pay their workers more or invest that money. If the investment is in productive projects that create jobs, it will help raise wages indirectly. However, one could also opt to invest in rent-seeking activities rather than in productive activities, which does not help raise wages at all. This is correct. This demonstrates that land value tax is needed in order to make high top marginal income tax rates work optimally. With a high top marginal income tax rate alone, companies have three rational options: (1) pay workers more, (2) invest in productive activities, or (3) invest in rent-seeking activities. With an LVT alone, CEOs have three rational options: (1) pay workers more, (2) invest in productive activities [rent-seeking ceases to be viable], or (3) simply line their own pockets by giving themselves wages. When both the high top marginal income tax and the land value tax are present, there are only two rational options: (1) raise wages or (2) invest in productive activities — neither rent-seeking nor lining of one’s own pockets are compatible with the incentives created by the tax structure at this point.

Reduced Land Values Lowers Cost of Living, So Revenue Would Still Be Sufficient

Another objection was raised to the effect that land value tax would be sufficient to fund a universal basic income because by reducing land values it reduces the cost of living. While the revenue generated would nominally shrink, it might actually be equivalent in real terms when adjusted to account for the change in the cost of living. This too is probably totally correct. You could fund a subsistence level basic income with a land value tax. However, it is my contention that as society creates more wealth, that wealth ought to be distributed in such a manner that the UBI in real terms actually increases proportionately to the increase in real wealth overall. LVT alone won’t be sufficient to fund such a thing. For instance, a company like Facebook makes most of its money off of collecting and selling data, an enterprise that takes place entirely in a fictitious cyber world. In the future, quantum computing will allow companies like Google and Facebook to put all their servers and computers in a tiny space. These companies would still be accumulating massive amounts of wealth but they won’t necessarily be using much land to carry out their business. This means that under a single-tax LVT system, the wealthiest companies in the world could actually end up paying no taxes. While a UBI pegged to the level of revenue captured by LVT would provide everyone with a subsistence level basic income, it would also allow runaway inequality. Imagine a world where the wealthy have destroyed the planet with pollution and carbon emissions. The wealthy all abandon Earth and decide to move to a “Galt’s Gulch” on the newly-terraformed Mars, abandoning the ordinary folks who aren’t rich enough to buy tickets to get off-planet. The wealthy leave the normal people all to burn on a dying planet. In order to avoid such a dystopian future with runaway inequality, I believe a VAT to capture a share of wealth from big tech and a high top marginal income tax rate are necessary. It is a combination of these three forms of taxation — a triple-tax model — that will create and foster a property-owning democracy that will actually raise all people together rather than leaving most of the human population behind while the bulk of the wealth accumulates at the top.

People Will Evade the Value-Added Tax

Another interlocutor objected that VAT could easily be evaded by cost-shifting and other measures. In reality, the extent to which VAT can successfully be evaded is greatly exaggerated by its opponents. Machine taxes and data-mining taxes could be easily evaded, as can corporate taxes. The VAT, however, is a consumption tax. The only way to avoid it entirely is to not consume. Since VAT is collected throughout the stages of production, every time value is added, part of it becomes an embedded tax, making it unavoidable. If you are an über-wealthy person or a corporation operating in a society that utilizes a VAT, you will end up paying more in taxes than you would under a corporate tax or regular income tax designed to generate the same amount of revenue. The collection of VAT is very indirect, making it really hard to evade compared to other taxes. Business-to-business transactions are almost always reported and VAT from such transactions are almost always paid. This is because one business’ tax liability is another business’ tax deduction. One business will keep its receipts to report its transactions in order to get its tax deductions, which alerts the tax authority, making it difficult for the other business involved to be able to get away with not reporting the transaction and paying the appropriate VAT.

Where evasion occurs with VAT is at the level of business-to-consumer transactions. The ordinary consumer can’t deduct the cost like a business would, so there is no reporting of a tax deduction to tip the tax authority off to the tax liability on the other end. São Paulo, Brazil, was able to address this problem by incentivizing consumers to report the transaction. They did this by offering a rebate directly to consumers. Consumers started reporting their transactions, which encouraged businesses selling directly to consumers to report theirs as well, since there was no way to know which transactions would be reported on the other end. This made it more risky to attempt to evade the tax.

In addition to taking measures to encourage consumers to report their transactions so that retailers have to report theirs, you could also impose harsh penalties to discourage attempts at evasion. For instance, if a business fails to report and their customer does, the penalty could be that the business now has to pay double the VAT on that transaction. So, while evasion is a problem, one which occurs with most types of taxes, it is one that can easily be dealt with.

Full Automation Would Free Up Land & End Capitalist Exploitation

Another objection was raised about land with regards to automation: if robots and machines do make land as a means of production obsolete, then exploitation can’t happen. Land monopoly is a necessary prerequisite to capitalist exploitation. Thus, full automation results in post-capitalism in the nature of the case. Imagine a fully-automated futurist utopia (or dystopia). Tiny nanobots in the air manufacture everything, from food to clothes to houses. If you want a pizza, the microscopic nanobots just rearrange atoms in order to fashion one out of thin air! Since the machines that do the manufacturing are so tiny, they don’t need land to house them — the owners of the nanobots don’t have to buy land to place their machines on because they can fit anywhere. Thus, the wealthy no longer need to monopolize land. The wealthy owners of the machines decide to go off and live in a “Galt’s Gulch,” forsaking the market system altogether. Instead of having the machines produce things to sell to consumers, they decide to just have the machines produce things that they want and need. The needs of the machine-owning class are met by their advanced technology. Meanwhile, the wealthy no longer have any reason to cling to the land. Since they don’t need land for manufacturing purposes, they relinquish the land monopoly. With free access to land, the remainder of the populace can easily engage in subsistence agriculture. So, this future, though it entails a lot of inequality, does not entail exploitation and, therefore, looks quite utopian.

I see several problems with this analysis. It is not at all apparent to me that exploitation will not occur. Supposing that the machines are monopolized by the wealthy class, the remainder of the population must turn to the land for subsistence or else must beg or serve the wealthy in order to survive. When the wealthy relinquish their land monopoly, the members of the former proletariat will end up fighting amongst themselves to control the land. The best pieces of land will be taken over by the most powerful players (or the people that take over those pieces of land will become the most powerful) — scarcity, land monopoly, and exploitation will be re-established. The only difference is the monopolists will be different people. Land-owners will end up hiring or enslaving others to work for them, resuming old fashioned feudalist/capitalist exploitation. At the same time, the means of avoiding this will be to turn to the rich and their machines. It seems to me that the rich would still be inclined to exploit the masses for entertainment purposes.

I prefer to frame the issue in republican terms of domination rather than in socialist terms of exploitation. Assume that there is no exploitation. Some group of the wealthy, while monopolizing the machines, decide to be benevolent and provide free food, clothing, houses, and other resources to the non-wealthy populace. There is no exploitation here, yet there is still no liberty for the non-wealthy. In republican theory, liberty is the absence of domination, where domination refers to a situation in which one person has the capacity to arbitrarily interfere in the decisions of another. In the “utopian” future we have envisioned, the populace in general is not free in the republican sense. Their survival depends upon the arbitrary benevolence of the upper classes. At any point, the upper classes could stop being benevolent and arbitrarily decide to let the masses starve. The general populace is like a “free slave,” whose master never interferes with their choices. Of course, the “free slave,” while free in a classical liberal sense (no one is interfering with his decision making) is not free in the republican sense because someone does have the capacity to interfere. As a republican, I think that the potentiality for exploitation or arbitrary interference to take place means that domination is still occurring. In the interest of minimizing domination and creating a free republic, I believe it would be better for us to enact policies that prevent the sort of inequality that allows exploitation and arbitrary interference to occur.

Furthermore, as a liberal-republican (synthesizing the views of John Rawls and Philip Pettit, I would argue that policies aimed at predistribution are necessary for creating a free and just society. From a Rawlsian perspective, the wealthy are obligated to prove that their wealth makes the poorest better off. If they cannot prove that their being allowed to hoard wealth to the exclusion of others actually improves the lot of those whom they exclude, then an intergenerational redistribution (a.k.a. predistribution) that ensures all people start at a relatively similar position is in order. This equalizing of starting points through predistribution is necessary to create true equality of opportunity.

It is my contention that a more egalitarian property-owning democracy is actually in the best interest of those at the top as well. The wealthy benefit from law, order, and stability. Failure to provide the masses with equal liberty will likely lead to instability. Why should I be forced to either do hard work cultivating the land or entertaining the machine-owning class while others live in a post-scarcity technological utopia? Why shouldn’t we just riot? Inequality and injustice raises such questions, which causes people to become restless. The instability this creates is not in anyone’s best interest. This is why folks like Warren Buffet, Bill Gates, and Elon Musk are actually in favor of higher taxes being imposed upon the wealthy in order to fund better welfare measures such as universal basic income. Republican distributism or property-owning democracy (a republic with widespread distribution of private ownership) is actually in everyone’s best interest. It is just as much in the interest of the folks at the top as it is of the folks at the bottom. If we don’t move in the direction of something like it, the empire will fall and so will the wealthy dynasties.

- Log in to post comments